Part I: Strategy & Market Reality

A Vision for Vibrant Innovation

Established through the vision and support of Rekha and Rizwan Koita (Koita Foundation), KCDH is not just a research center; it is a vibrant department designed to make groundbreaking discoveries and train the next generation of digital health professionals.

Executive Summary: Strategic Blueprints for India's Digital Health

The KCDH 2026 Workshop on the Digital Transformation of Hospitals provided a strategic roadmap for the next decade of healthcare in India. This report condenses key insights from leaders at KCDH, NHA, CDAC, and NABH into five core strategic takeaways:

- The Standard Trinity (ABDM Compatibility): Seamless interoperability is no longer optional. Adopting the "Standard Trinity" of FHIR (Data Structure), SNOMED CT (Clinical Meaning), and DICOM (Imaging) is the only path to national data portability under the ABDM.

- Digital Transformation as Value Creation: Digital Health is not an "IT project" but an organizational and cultural shift. Every investment must map to strategic hospital goals—Quality, Patient Experience, and Revenue Velocity (e.g., reducing discharge TAT).

- Clinician-Centric Design Thinking: Success depends on reducing, not increasing, the "operational load" on doctors. Successful systems treat clinicians as co-designers rather than just end-users, focusing on workflow alignment over generic features.

- The Agentic & Multimodal Frontier: The future lies in Agentic AI—autonomous agents that assist in real-time orchestration—and Multimodal Fusion, combining Histopathology and Genomics to achieve "Holy Grail" precision in oncology.

- National Sovereignty & Infrastructure Scale: India is moving beyond scanned PDFs to Queryable Digital Data, backed by a massive 30,000 GPU backbone. The "Phygital" model (Physical + Digital) ensures this high-tech foundation reaches the "last mile."

Business Considerations in Digital Transformation (Dr. Richa Singh)

Following the strategic session on entrepreneurship, Dr. Richa Singh (Program Director, KCDH) presented a foundational framework centered on Design Thinking, Market Trends, and Business Economics for healthcare transformation.

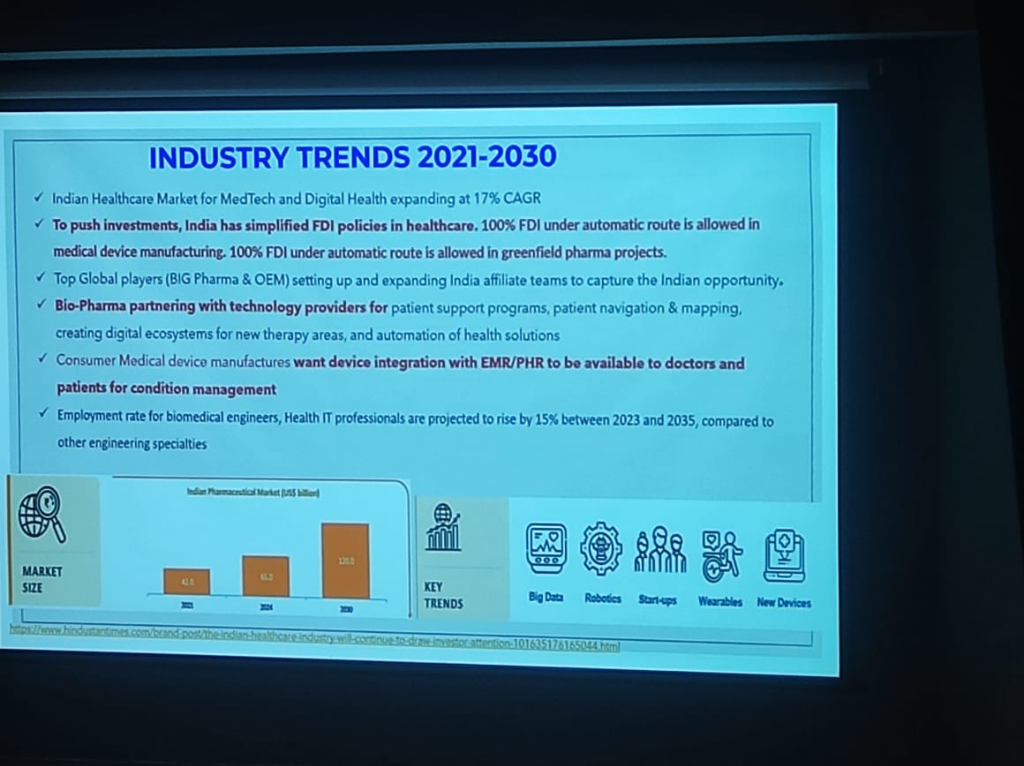

Industry Trends 2021-2030: The Digital Explosion

Dr. Richa Singh (KCDH) provided a forward-looking roadmap for the Indian healthcare market, projecting a decade of unprecedented growth.

Figure: Key trends shaping the Indian healthcare landscape through 2030.

Figure: Key trends shaping the Indian healthcare landscape through 2030.

- 17% CAGR Growth: The market for MedTech and Digital Health is expanding at a robust 17% compound annual growth rate.

- Investment Simplification: India has simplified FDI policies, allowing 100% FDI under the automatic route for medical device manufacturing and greenfield pharma projects.

- Global Affiliate Expansion: Top global players (BIG Pharma & OEMs) are expanding their India-based teams to capture this regional opportunity.

- Tech-Pharma Partnerships: Bio-Pharma is increasingly partnering with technology providers for patient support programs, navigation, and therapy-area automation.

- The Talent Surge: Employment for biomedical engineers and Health IT professionals is projected to rise by 15% (2023-2035), outpacing most other engineering specialties.

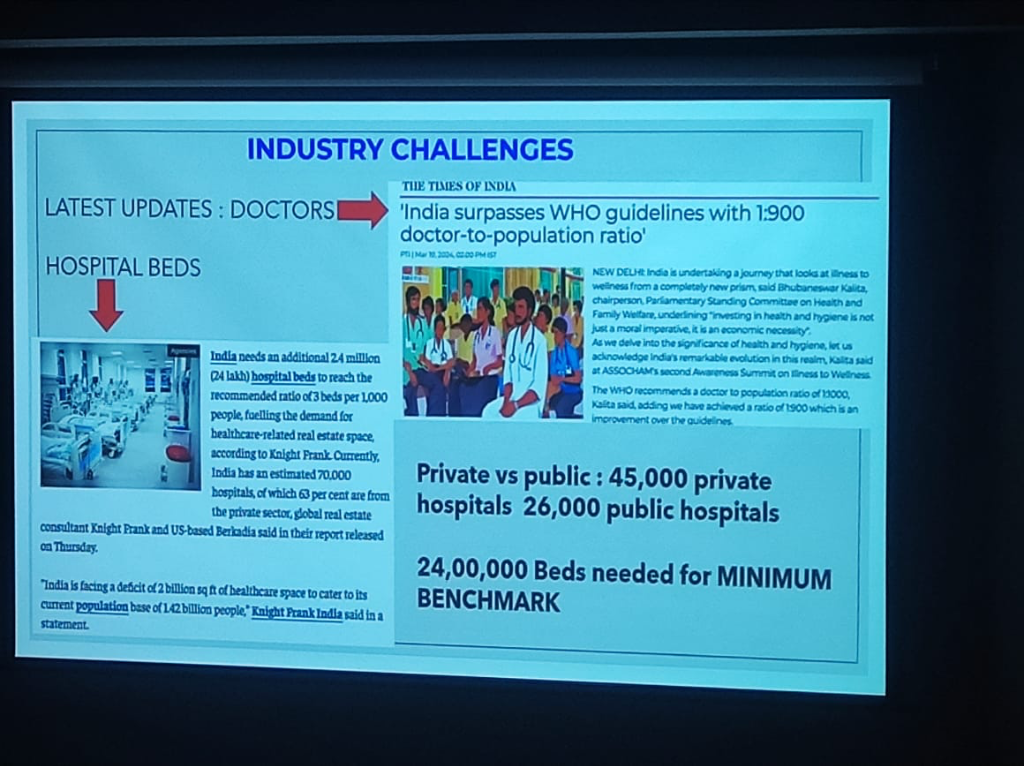

The Reality of Gaps: Infrastructure & Human Capital

Despite the growth, the session highlighted the sheer scale of the challenges remaining in the Indian ecosystem.

Figure: The infrastructure and human capital gaps in Indian healthcare.

Figure: The infrastructure and human capital gaps in Indian healthcare.

- The Bed Deficit: India needs an additional 2.4 million (24 lakh) hospital beds to reach the recommended ratio of 3 beds per 1,000 people.

- Doctor Ratios: India has recently surpassed the WHO guideline of 1:1,000 with a 1:900 doctor-to-population ratio, a significant milestone, though distribution remains a challenge.

- Sector Split: The landscape is dominated by 45,000 private hospitals vs. 26,000 public hospitals, emphasizing the need for private sector integration into national digital missions.

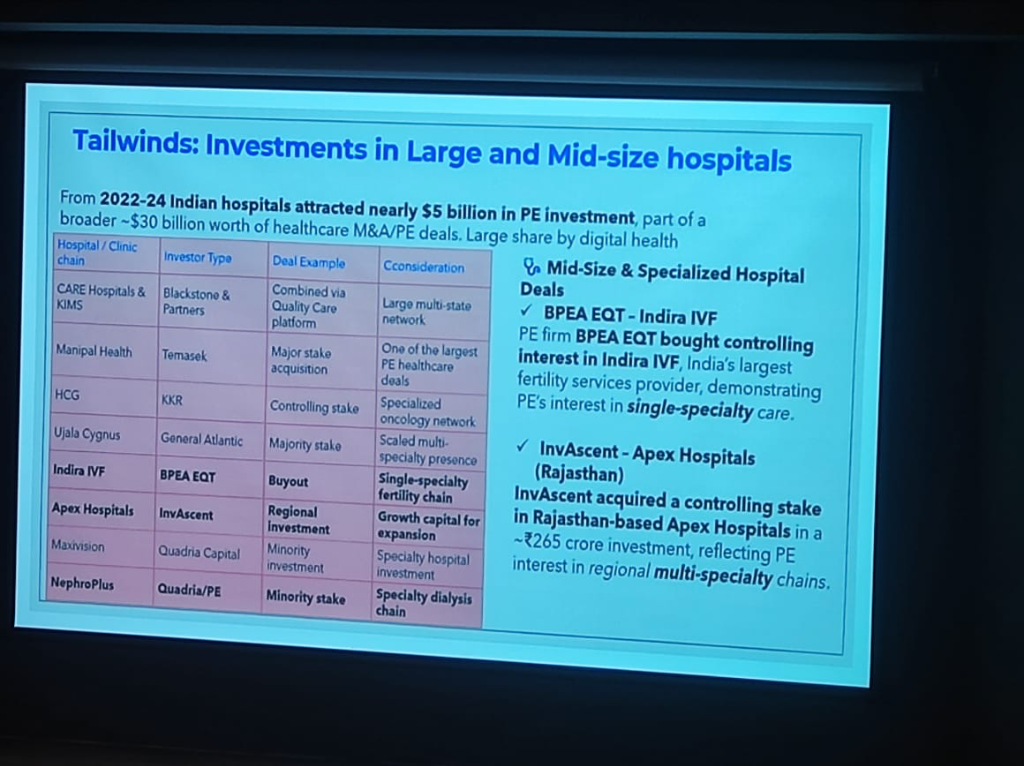

Investment Tailwinds: PE & M&A Activity

The strategic importance of Indian healthcare is reflected in the massive capital flows into the sector between 2022 and 2024.

Figure: The landscape of Private Equity and M&A deals in Indian healthcare (2022-2024).

Figure: The landscape of Private Equity and M&A deals in Indian healthcare (2022-2024).

- PE Influx: Indian hospitals attracted nearly $5 Billion in PE investment over the last two years.

- M&A Volume: A broader $30 Billion worth of healthcare M&A and PE deals were recorded, with a significant share driven by digital health integration.

- Strategic Consolidation: Major deals include Blackstone's acquisition of CARE Hospitals/KIMS and Temasek's major stake in Manipal Health.

- Specialized Growth: PE firms like BPEA EQT and InvAscent are focusing on single-specialty chains (e.g., Indira IVF) and regional multi-specialty platforms.

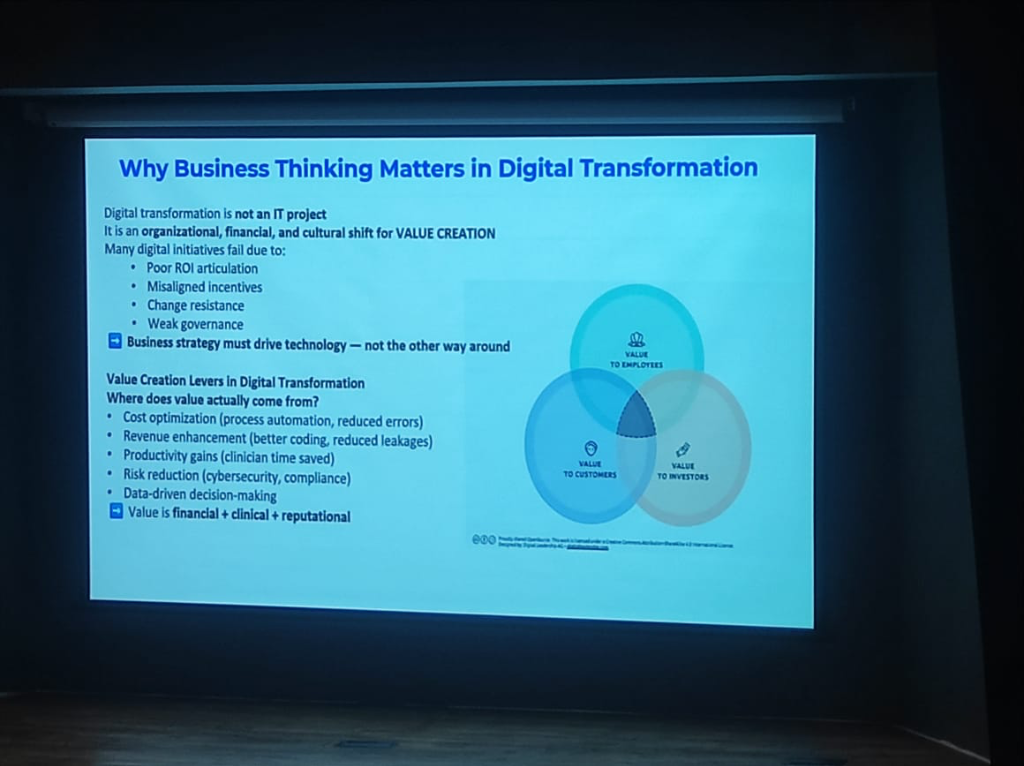

Business Thinking: The Value Creation Shift

A profound takeaway from Dr. Richa Singh's session was that Digital Transformation is not an IT project. It is an organizational, financial, and cultural shift aimed at Value Creation.

Figure: The value creation levers in digital transformation, bridging employees, customers, and investors (Source: Dr. Richa Singh).

Figure: The value creation levers in digital transformation, bridging employees, customers, and investors (Source: Dr. Richa Singh).

- Why Initiatives Fail: Many digital projects falter because of poor ROI articulation, misaligned incentives, change resistance, or weak governance.

- Value Creation Levers: True value in digital health comes from:

- Cost Optimization: Process automation and reduced clinical errors.

- Revenue Enhancement: Better coding and reduced leakages.

- Productivity Gains: Saving precious clinician time.

- Risk Reduction: Ensuring cybersecurity and regulatory compliance.

- The Value Triad: Value must be measured across three dimensions: Financial, Clinical, and Reputational.

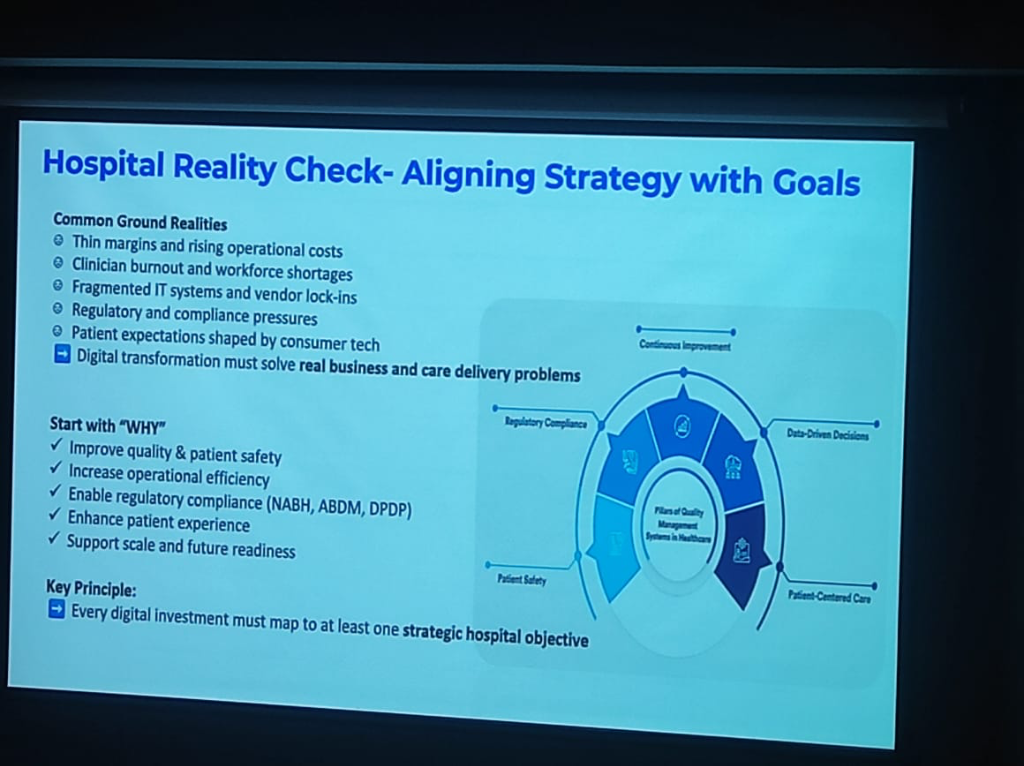

Hospital Reality Check: Aligning Strategy with Goals

Dr. Richa Singh provided a "Reality Check" for innovators, highlighting the common ground realities that every digital strategy must address.

Figure: Aligning digital strategy with strategic hospital objectives and operational realities.

Figure: Aligning digital strategy with strategic hospital objectives and operational realities.

- The Challenges: Hospitals operate under thin margins, rising costs, clinician burnout, fragmented IT systems, and intense regulatory pressure.

- Start with "WHY": Every digital investment must map to at least one strategic hospital objective:

- Quality & Patient Safety: Improving clinical outcomes.

- Operational Efficiency: Streamlining workflows.

- Compliance: Adhering to standards like NABH, ABDM, and the DPDP Act.

- Patient Experience: Meeting the expectations shaped by modern consumer tech.

- Key Principle: Strategy must drive technology—not the other way around. Having the right information at the right time is the ultimate goal of clinical digitization.

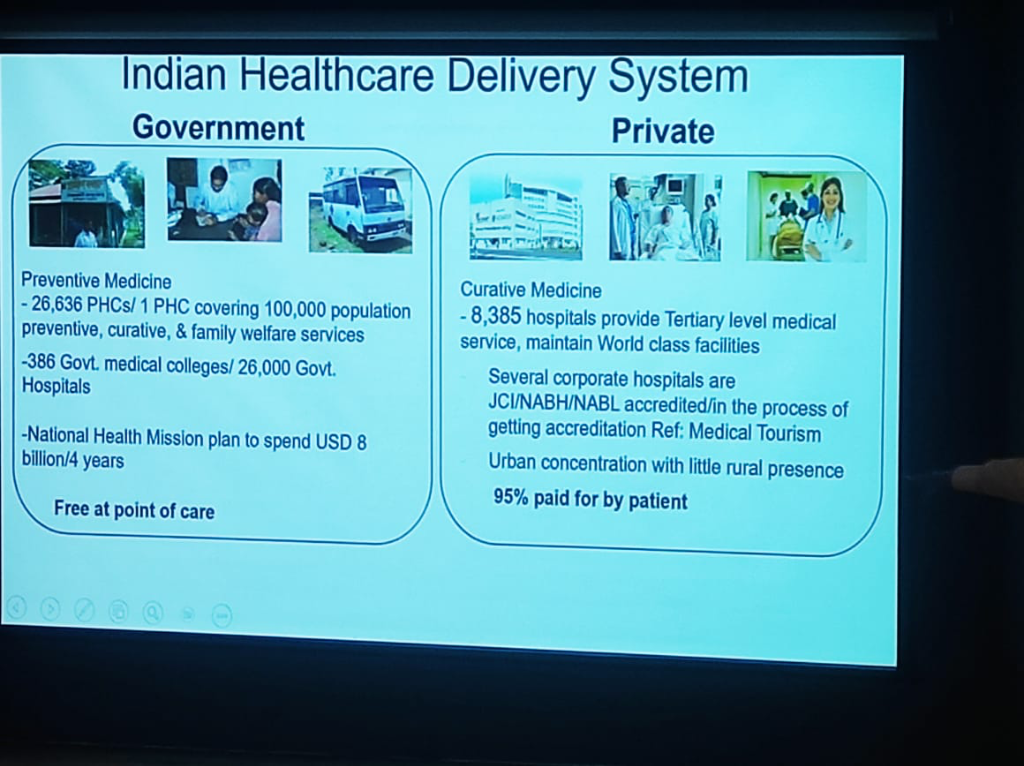

The Indian Healthcare Duality

Dr. Prabhu provided a structural overview of the two-speed healthcare system that ABDM serves, anchored in a stark contrast between the public and private sectors.

Figure: The structural contrast between Government (Preventive-First) and Private (Curative-First) healthcare delivery in India.

Figure: The structural contrast between Government (Preventive-First) and Private (Curative-First) healthcare delivery in India.

- Private Healthcare (Curative-First):

- Scale: Comprises 8,385 tertiary hospitals providing world-class medical services.

- Accreditation: Many are JCI/NABH/NABL accredited, positioning India as a global hub for medical tourism.

- The Gap: Despite its excellence, the sector has a heavy Urban Concentration with little rural presence.

- The Cost: A staggering 95% of costs are paid for by the patient, a financial burden that ABDM’s transparency and NHCX integration aim to mitigate.